Back in the 2000s insurance agencies pondered whether or not websites were worth it. I think we got our answer to that one.

But now that very same question has shifted to social. What can Facebook, Twitter and LinkedIn actually accomplish for an insurance agency? Is it senseless chatter, a bottom line booster or something in-between?

In the third installment of our 3-part insurance and digital marketing series, we’ll take a look at how, or more accurately, if insurance agencies are calculating return on investment for their traditional and nontraditional (digital) marketing programs.

First off, let it be known that there is a difference between value and ROI. The value of social media is a qualitative question: is social media worth it? Answers typically take the form of, “Yes, niche engagement and enthusiasm adds value to your brand.” Social ROI, on the other hand, is a quantitative measurement that gives CMOs and CEOs a look at how the value of social media looks in rankings, percentages and bottom line revenue.

Now let’s jump into the data. In March 2012 Insurance Insight, The Journal of the Independent Insurance Agents of Illinois released a survey analyzing the digital marketing habits of approximately 300 agencies across the US and Canada. We’ll use these datapoints to examine the insurance industry’s approach to social ROI.

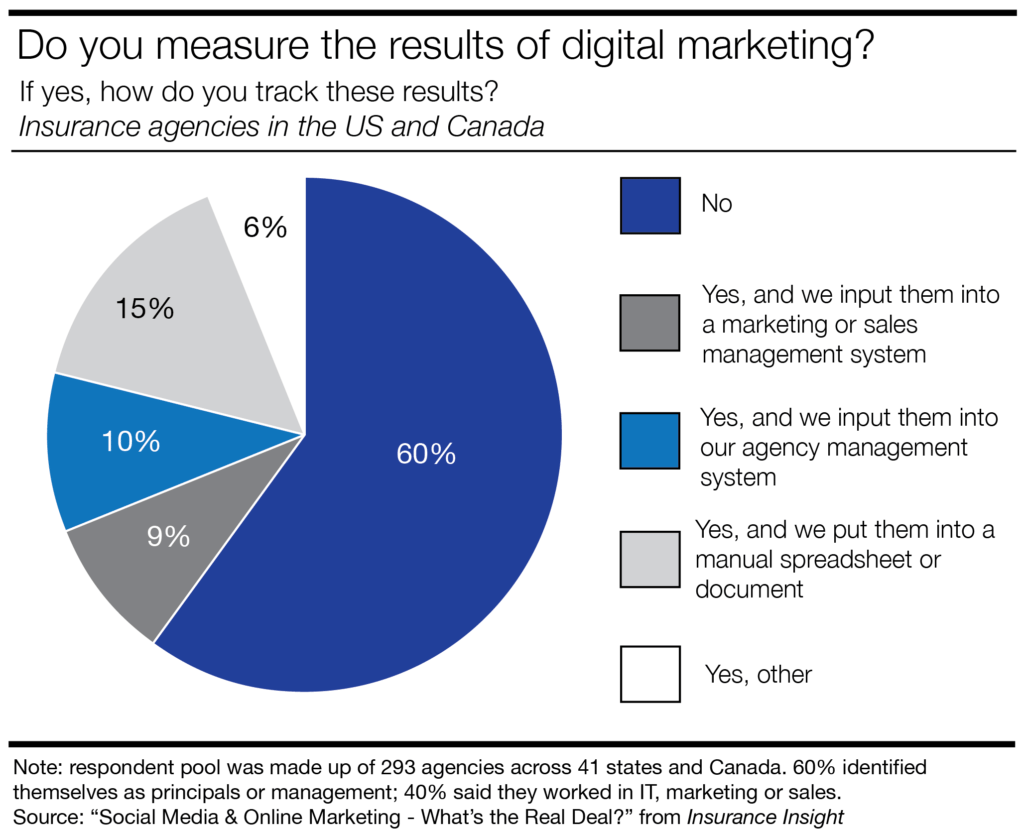

Results show that 60% of surveyed insurance agencies do not measure the results of digital marketing efforts. Of those who do measure ROI, the most common tactic for tracking results is a manual spreadsheet or document.

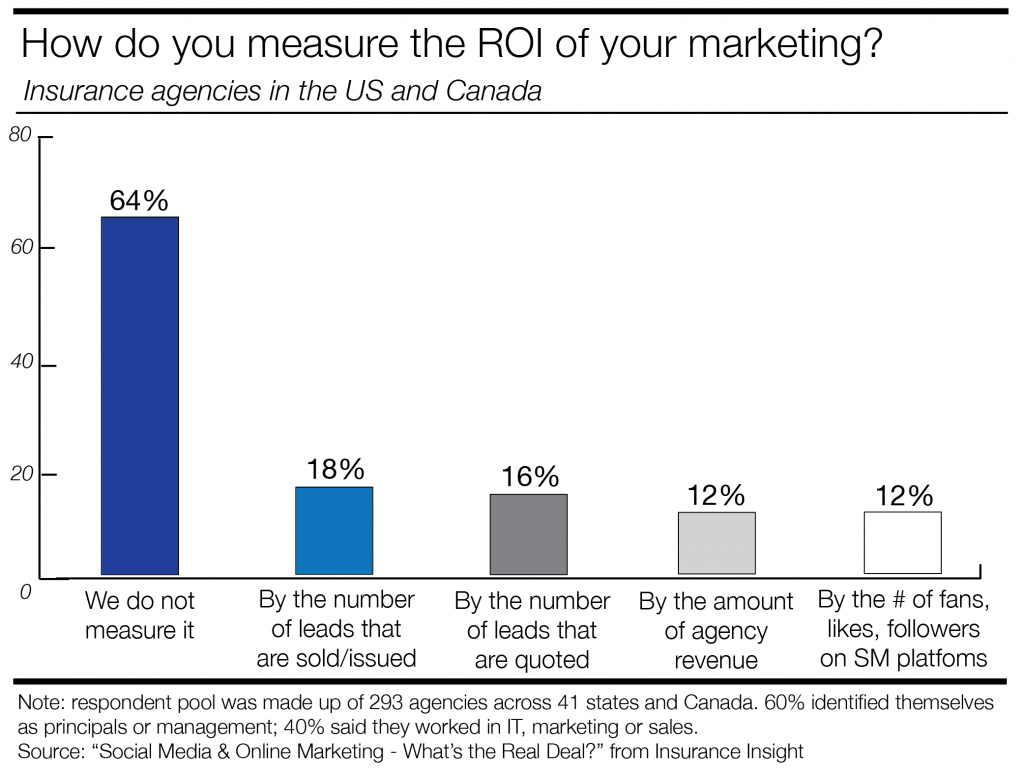

The survey also took a look at the metrics insurance agencies use to track general marketing ROI (including traditional marketing methods). 64% said they do not track any of their marketing efforts. 18% said they look at the number of leads that are sold or issued, while 16% said that they track the number of quotes given and 12% measure ROI by looking at agency revenue. Finally, 12% said they track marketing ROI by looking at social engagement numbers such as likes and followers.

Looking at the Insurance Insight study as a whole, it appears that the insurance industry is behind when it comes to two key elements of digital marketing: strategy planning and ROI measurement. Without a plan or metric to look at progress, agencies are really just grabbing at straws when it comes to digital. The most successful interactive campaigns are planned, measured and then optimized in order to produce the best results.