Mobile ad spending from the finance industry is growing and growing quickly. But who exactly consumes mobile content and ads from insurance, banking and financial services brands?

“Mobile Insights for Finance Brands,” a recent study from Millennial Media and comScore takes a closer look at this segment of the mobile community, revealing a host of statistics that will influence mobile strategy for brands in the financial services vertical. The term “mobile finance users” refers to consumers who engage with finance content and ads on their mobile devices.

Devices

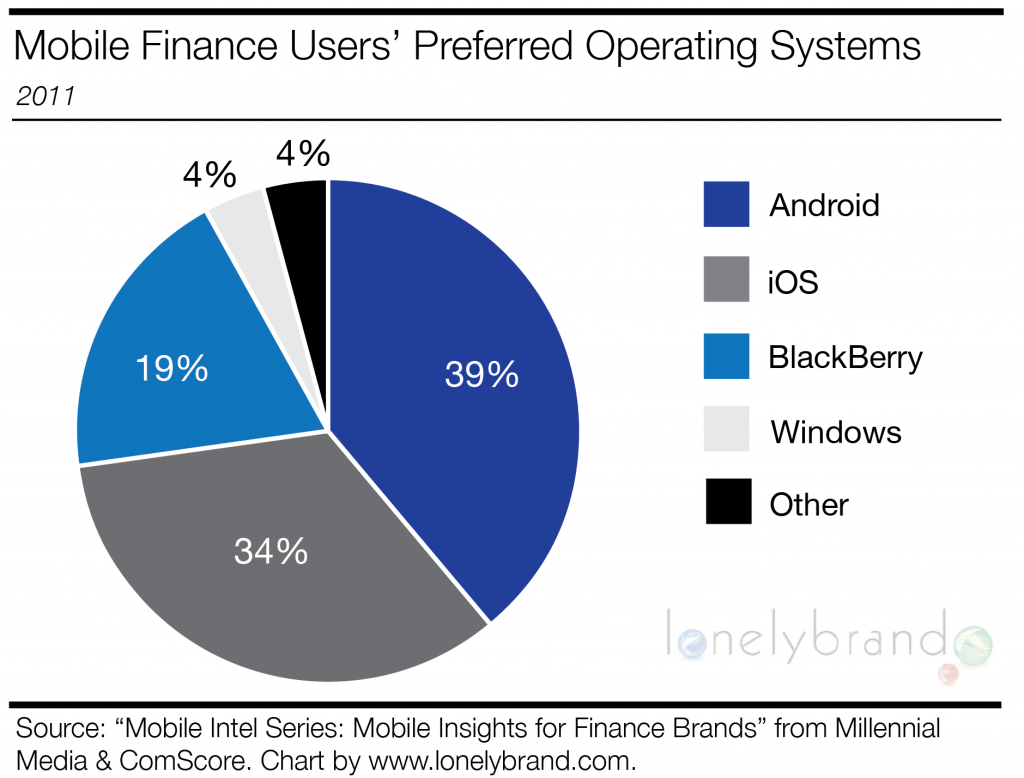

According to the study, 80% of mobile finance users own a smartphone, and the top platform of choice among this audience seems to be Android, with iOS coming in at a close second.

37% of mobile finance users own a non-phone connected device such as a tablet. iPads are the most popular of these devices (12%), followed by iPod Touch (7%) and Kindle (6%)

Audience Demographics

Overall, mobile finance users skew young and wealthy, with the most prominent segment being young males between the ages of 18 and 34. Men and women have a pretty even split among this audience, with men at 55% and women at 45%.

Income-wise, this segment of consumers tends to land in a higher bracket than mobile users in general. Mobile finance users over-index general mobile users in the $75,000 – $100,000 range, as well ast the $100,000 and up range.

Audience Behaviors

According to this study, mobile finance users consider themselves to be environmentally friendly, health-conscious and influential. They are also more likely than general mobile users to consider themselves tech-savvy, fashion conscious or willing to take risks.

Buying Behaviors

When it comes to buying behaviors, mobile finance users tend to place value on brand names, and are often willing to pay more for a trusted company. And nearly 50% of these users say that when they find a brand they like, they’ll stick with it.

Mobile Access Habits

Of the various segments within the financial services industry, banking is the most-frequently accessed, but users still value the ability to get insurance-related content on mobile devices.

These users don’t flock to mobile insurance content all the time, but they do seem to return semi-regularly. Six percent access mobile insurance content every day, another 6% do so once a week, and 10% tap into this content between one and three times per month.

The most popular place for mobile finance users to access insurance content is on their browser (17%), but 10% use mobile applications and 6% rely on SMS content.

Preferred device, age range and other interests encourage more precise mobile targeting while revealing other digital tactics that may supplement and amplify the overall communications program.