Twitter has released new data about its growth, and the numbers are troubling for the global social network. Marketers that spend time and ad dollars in the space built on 140 characters should pause to understand why.

The concept of a social network death spiral rises from two key metrics: declining interest from Wall Street investors and cooling enthusiasm from marketers who represent valuable revenue for the social network. Together these factors can lead to an inability to grow quickly and a stagnation of ad product innovation.

No Love from Wall Street: A Money Problem

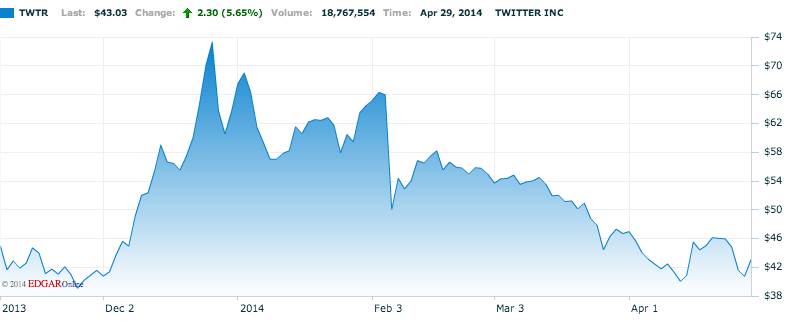

Twitter failed to wow Wall Street with its first ever quarterly earnings report since the social network went public in November of 2013.

After a run up in late December 2013 to nearly $74 per share, Twitter (TWTR) has now fallen to half that value due to reduced market enthusiasm for “momentum” stocks and poor growth in daily active users (DAUs) and monthly active users (MAUs).

Twitter (TWTR) share price action since IPO:

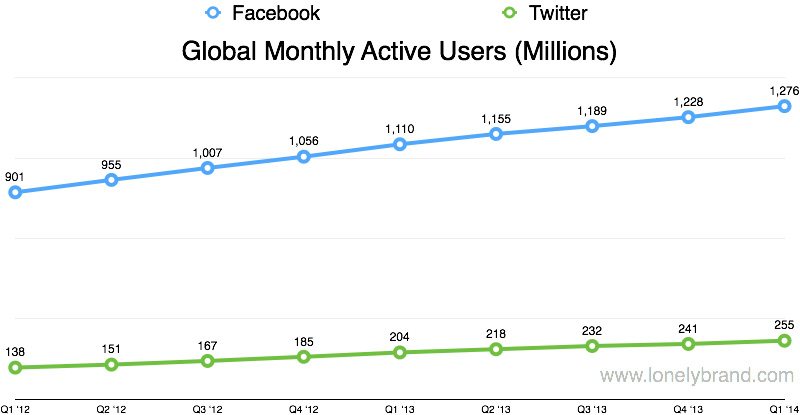

Twitter user growth is looking tepid when compared to other, thriving social networks like Facebook and Instagram (also owned by Facebook) that continue to earn a healthy boost in MAUs each month.

Source: www.lonelybrand.com

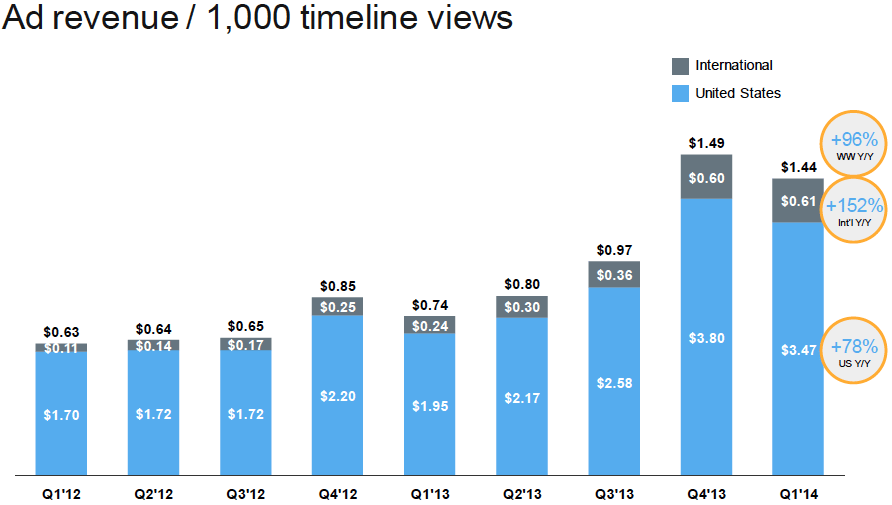

Twitter’s ad revenue seems to be on the decline when viewed monthly, despite big increases year over year.

Source: Twitter’s first quarterly report to Wall Street dated April 29, 2014

No Love from Marketers: An Image Problem

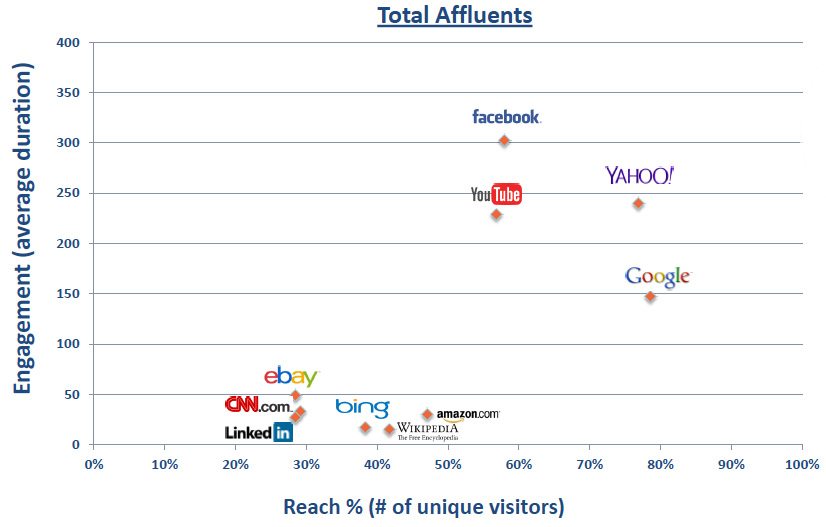

The simple fact that revenue is absent should not bother marketers. Nor should slowing growth due to sheer size of current audience. Many marketers are struggling with the coolness factor of Twitter amongst desirable target audience groups. For example, the latest data from Ipsos and comScore shows marketers should think twice about expending effort in Twitter when engaging affluents until social networks like Facebook, YouTube and LinkedIn have been exhausted.

Source: Ipsos Affluent Survey USA/comScore Q1 2014

Tweets for Thought

Twitter’s problems alarm both sides of the brain. Quantitative issues of money and growth are mixed equal parts with qualitative loss of “cool factor” when compared to young, fast-growth social networks like Instagram, Vine and Pinterest.

There’s a silver lining. The utility of Twitter cannot be denied, and while foreign revolutionaries can’t bring in ad revenue, more lucrative consumer markets continue to use the tool in niche segments. Brands may continue to find value in tapping Twitter for these niche audiences, utilizing its paid platform to do so.

A Bird in the Hand

Twitter has the potential to reclaim its momentum status through innovative product development. This development could come in the form of new ad modules that solve pain points for brands (like turnkey contest and sweepstakes modules) or more clearly defining what niche audiences the social network absolutely owns. It may be time for Twitter to stop pretending it covers all demographics equally and start telling marketers whom it engages best.

Until it is clear how Twitter is making good on bringing marketers and Wall Street back into the fold brands should proceed with caution, opting to invest only in reaching those niche segments that have proven successful in the past.

Twitter’s first quarterly report to Wall Street dated April 29, 2014

Disclosure: At the time of the publication of this article I am holding long options contracts in Facebook (FB). I have no positions in any other stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.